Credo AI versus Credal

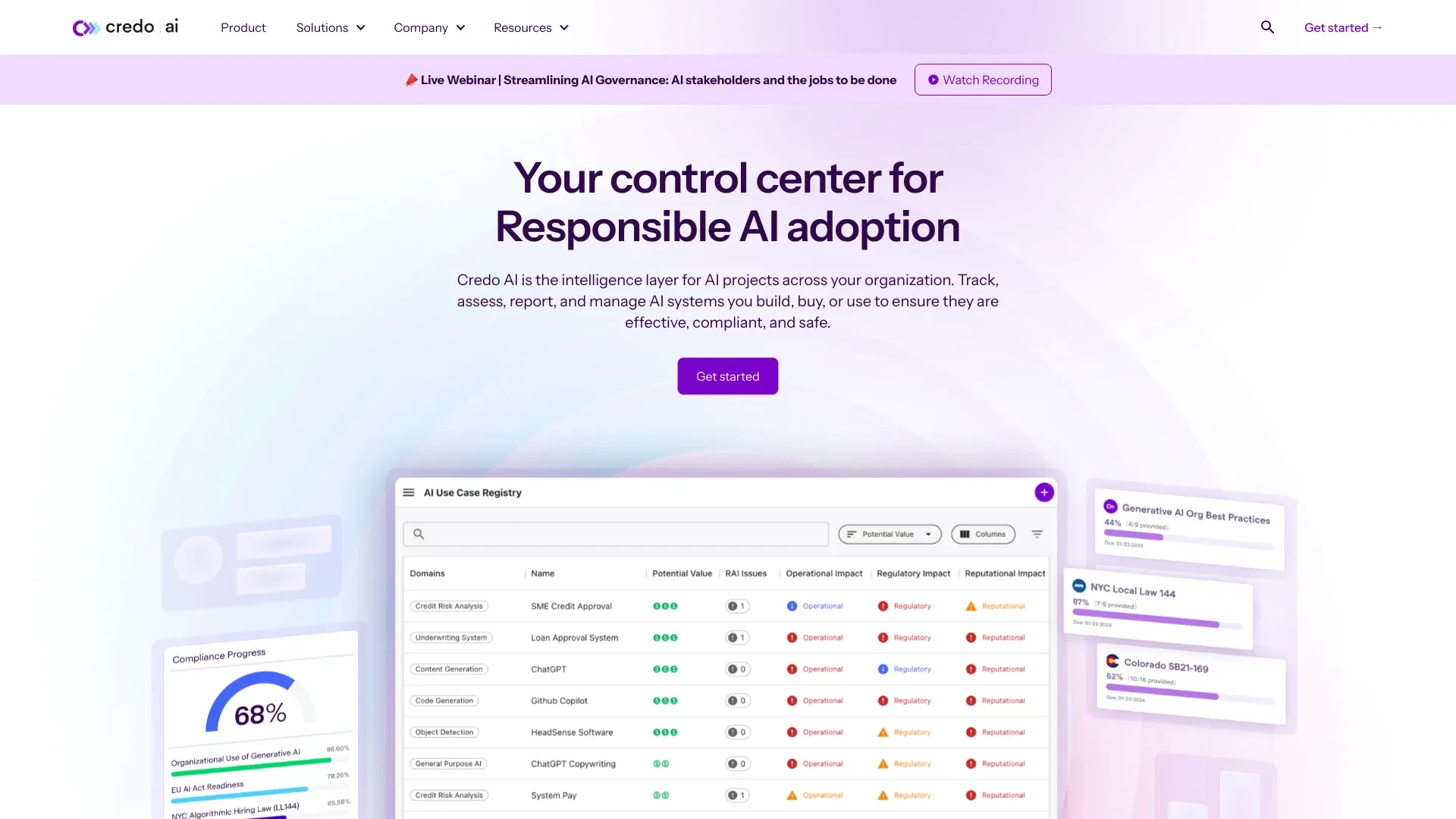

Credo AI

Ideal For

Automating AI oversight

Risk mitigation

Ensuring regulatory compliance

Enhancing AI system effectiveness

Key Strengths

Streamlines AI governance processes

Reduces risks associated with AI adoption

Enhances compliance with regulations

Core Features

AI Compliance & Standards

AI Adoption Tracking

AI Risk Management

Generative AI Guardrails

Regulatory Compliance

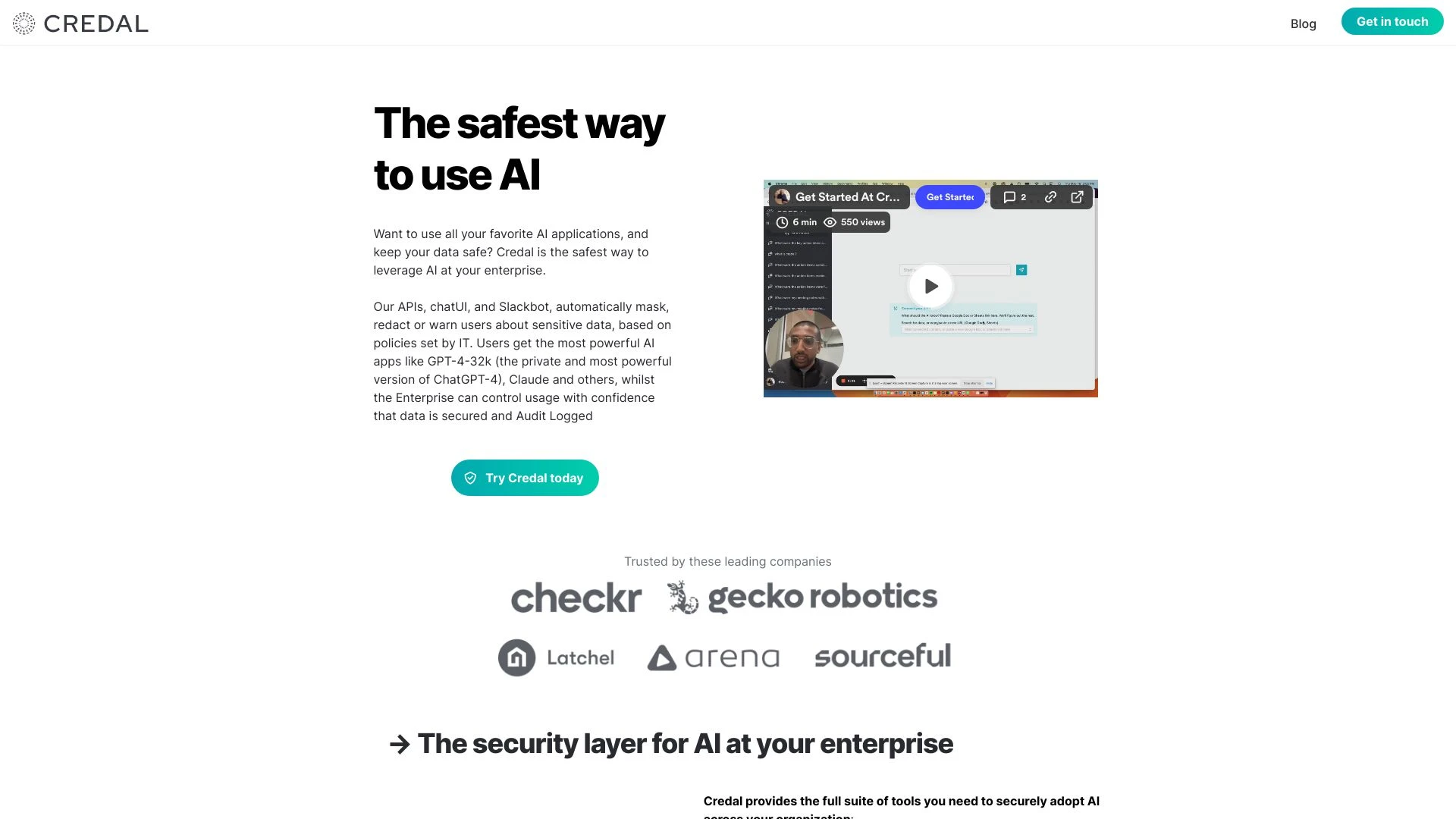

Credal

Ideal For

Redacting sensitive data before sharing with AI providers

Enforcing acceptable use policies for AI tools

Managing permissions and access to documents and channels

Building custom applications using secure APIs

Key Strengths

Ensures data privacy

Enables compliance with regulations

Streamlines AI tool integration

Core Features

Walk-up usable secure chat UI

Secure Slack bot

Point-and-click data connectors

Access control and security enforcement

Sensitive data redaction

Popularity

Decision Matrix

| Factor | Credo AI | Credal |

|---|---|---|

| Ease of Use |

|

|

| Features |

|

|

| Value for Money |

|

|

| Interface Design |

|

|

| Learning Curve |

|

|

| Customization Options |

|

|

Quick Decision Guide

- You want robust AI governance and compliance capabilities.

- You aim for simplified risk assessments and reporting.

- You value transparent AI model tracking and audit trails.

- You look for user-friendly interfaces and accessible tools.

- You prioritize collaboration across cross-functional teams.

- You want advanced AI-driven insights for decision-making.

- You aim for enhanced accuracy in credit assessments.

- You value seamless integration with existing systems.

- You look for real-time data analysis and reporting.

- You seek user-friendly interfaces for efficient usage.